rental income tax malaysia

The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding. Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment.

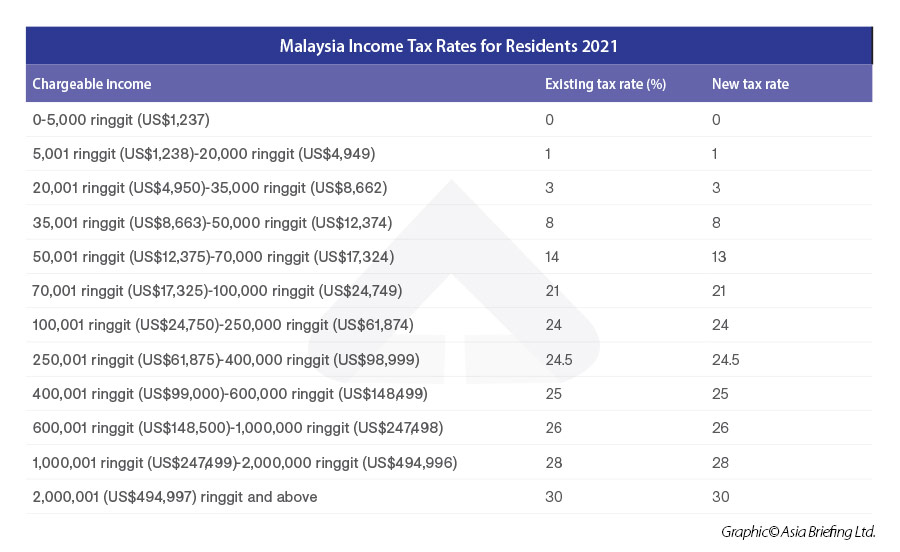

Individual Income Tax Amendments In Malaysia For 2021

Rental Income Received in Advance 18 10.

. It is also calculated on a net basis where all claimable. Income Tax Special Deduction for Reduction of Rental to a Tenant other than a Small and Medium Enterprise Rules 2021 PU. Set under a separate category rental income tax comes with its own progressive tax rates that range between 0 and 30.

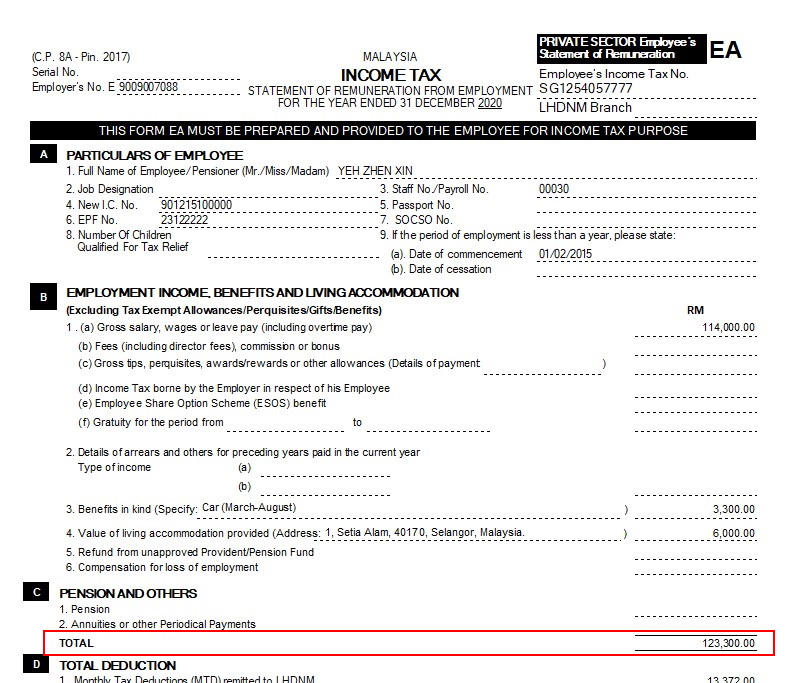

Rental income does not exceed. When rental income is assessed under section 4 d it. Capital Allowance 25 11.

This can range anything from 2 to 9 depending on whether the. Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents.

Rental income is valued on a net basis which. Rental income tax is a tax imposed upon profit that you make from renting out properties. A 3542021 These Rules apply to landlords.

The rental income applies to both residential and commercial properties and even. Expense Relating to Income of Letting of Real Property 13 9. Rental income in Malaysia is taxed at a progressive rate ranging from 0 to 28 percent depending on the amount earned.

Rental income is taxed at a flat rate of 24. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. The Malaysian Inland Revenue Board issued a set of updated frequently asked questions FAQs on the special tax deduction available for landlords that.

Any person whether resident or non-resident citizen or non-citizen individual or not who derives rental income from Malaysia is thus subject to income taxThe type of person or the residence. You will only need to pay tax. Rental income tax is a tax imposed upon profit that you make from renting out properties.

Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. March 1 2021.

For the 2018 to 2020 years of assessment a 50 exemption applies to rental income received from residential homes if the following conditions are met. 100 US 400 MYR 3 Estimated values. The rental income applies to both residential and commercial properties and even.

2 Exchange rate used. Basically if you dont declare the accurate amount of income youre receiving youll be fined anywhere between RM1000-RM10000 AND pay double the amount of tax which you had failed. The tax is calculated based on the annual rental value of the property which is then multiplied by a fixed rate.

If your rental income is considered as a non-business income you will need to add the amount youve generated from the rental to your total income. Industrial Building Allowance 28 12. Azrie owns 2 units of apartment and lets out those units.

In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967.

Airbnb Rental Income Statement Tracker Monthly Annual Etsy

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Calculate Your Chargeable Or Taxable Income For Income Tax

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Perlindungan Ekonomi Rakyat Malaysia Permai Assistance Package Hlb Ler Lum Chew

5 Things To Consider When Filing Taxes On Rental Income Free Malaysia Today Fmt

Computation Of Buss Income Computation Of Statutory Business Income For Ya Rm Net Profit Before Studocu

Avoiding Rental Income Tax Pitfalls In Malaysia

Malaysia Bracing For Taxation Of Foreign Sourced Income Bloomberg Tax

Rental Property Is Now The Right Time To Sell

Real Property Gains Tax 101 Malaysian Taxation 101

Property Tax In Malaysia Real Estate Glossary Malaysia Property Property For Sale And Rent In Kuala Lumpur Kuala Lumpur Property Navi

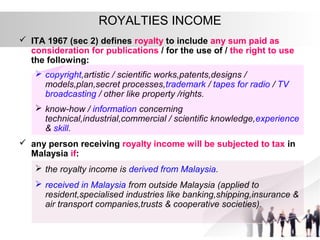

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Avoiding Rental Pitfalls Asean Economic Community Strategy Center

M Sian Landlords May Not Need To Declare Tax On Asklegal My

Pdf Property Tax Management Model Of Local Authorities In Malaysia

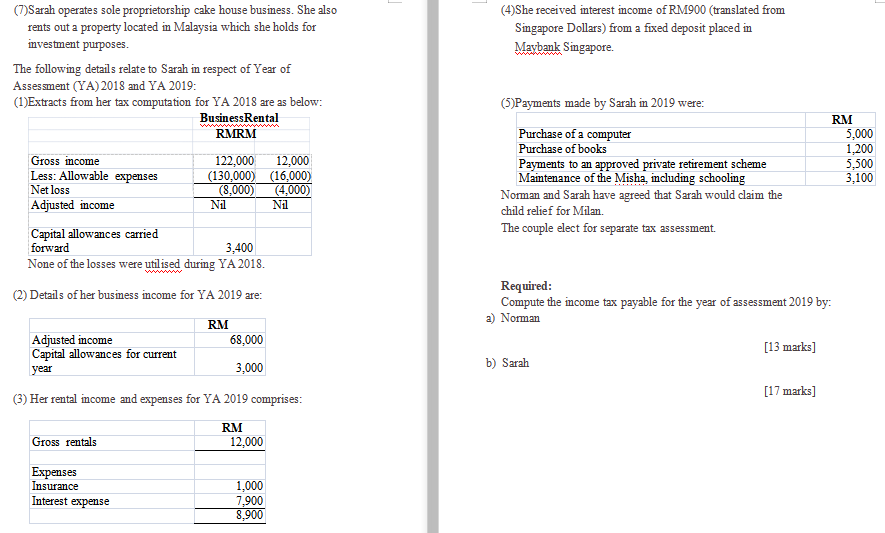

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

German Rental Income Tax How Much Property Tax Do I Have To Pay

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Comments

Post a Comment